India’s economy continues to demonstrate robust growth, with Q3 2025 GDP surging 7.4% year-over-year, outpacing expectations and solidifying its trajectory toward becoming the world’s fourth-largest economy by surpassing Japan, per IMF projections. Retail inflation has eased to a multi-year low of 3.34% in March 2025, supported by effective RBI policies, while exports rose 6% to $602 billion in April-December 2024, bolstered by manufacturing FDI up 18% under “Make in India”. Globally, the US posted strong Q3 GDP at 4.3% annualized, driven by consumer spending on services, though consumer confidence dipped for five straight months amid recession risks.

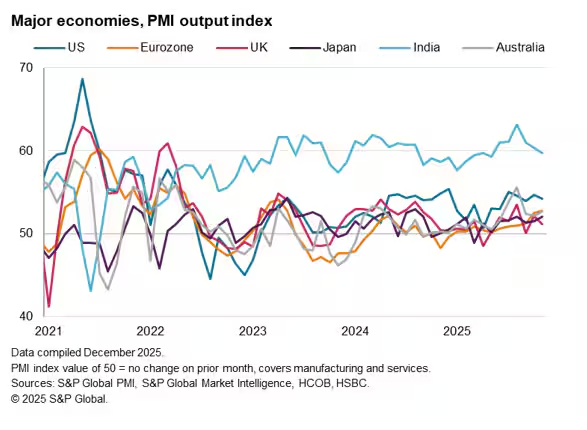

On the world stage, growth forecasts hold steady at 3.2-3.4% for 2025-2026, with advanced economies like the eurozone accelerating via ECB rate policies, while emerging markets like India lead with 6.5-6.6% GDP expansion. Challenges persist from geopolitical tensions and moderating PMIs in the US and India, yet optimism rises in domestic outlooks, with 42% of executives expecting national improvements in the next six months. For stock investors, these indicators signal opportunities in resilient sectors like manufacturing and services, but vigilance on inflation and trade dynamics remains key.